Financial documents are designed to provide insights into the financial health of the company.

#Understanding cash flow how to

HOW TO ANALYZE AND UNDERSTAND YOUR CASH FLOW STATEMENT?Īs with any financial statement analysis, one must always look at it from a business perspective. Cash flow from financing: Reports on expenses and income related to the financing of the company (payment of dividends, loans).

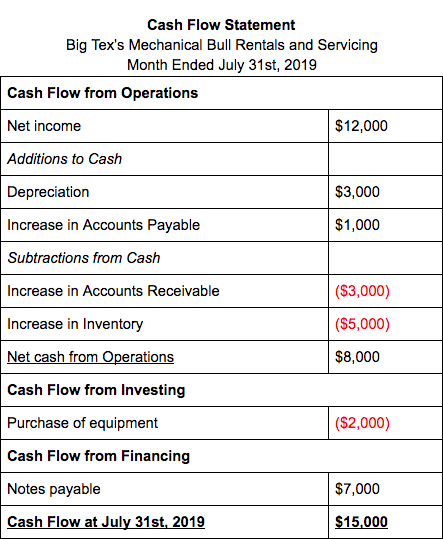

Investment cash flow: Includes the recurring expense for the purchase of fixed assets.Activity cash flow: Indicates the cash surpluses generated by the company’s own activity.To capture cash flow, it can be divided and calculated in three categories that can help us to manage and interpret it: To calculate the cash flow for a given period, it is a very simple calculation:Ĭash Flow = Net income + depreciation + amortization + provisionsīut, one of the great advantages of cash flow is that we can divide it into 3 different points of view that allow you to know where expenses come from and how we can optimize them THE STRUCTURE OF A CASH FLOW STATEMENT This allows us to know how the health of the company is and if you have the necessary liquidity to meet all the company’s expenses. To help you understand cash flow, we would like to give you a brief recap: the cash flow statement is one of the main accounting statements. Therefore, in this article we tell you how to analyze and understand your cash flow statement.īut we get it: not everyone has expertise in finance or accounting, so understanding cash flow can be a challenge for the management team. On the other hand, an investor can also use it to know if he/she would invest in the company.

Any entrepreneur needs to know how to analyze and understand your Cash Flow Statement to be able to extract relevant information about the health of the company.

0 kommentar(er)

0 kommentar(er)